Determine mortgage payment

Your insurance provider covers 125 of your mortgage. Mortgage programs which require a minimal down payment.

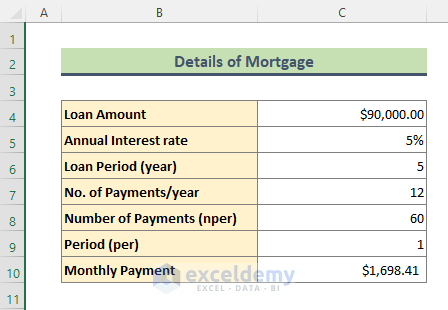

How To Calculate Monthly Mortgage Payment In Excel

Factors that impact affordability.

. Determine how much income is required to qualify for your desired loan amount. Bi-Weekly Mortgage Payment Calculator Terms. Your mortgage payment includes your principal and interest down payment loan term homeowners insurance property taxes and HOA feesThis gives you the ability to compare a number of different home loan scenarios and how it will impact your budget.

A fast and simple mortgage payment calculator online web app that gives you data fast easy. Use the Fixed Term tab to calculate the monthly payment of a fixed-term loan. Most low-down mortgages require a down payment of between 3 - 5 of the property value.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Conforming Fixed-Rate estimated monthly payment and APR example. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac.

When deciding how much you should spend on a house youll want to consider factors such as DTI monthly mortgage payment amount the expenses of homeownership and your household budget. USDA loans are available in 15 and 30-year terms. There are a couple of ways to reduce parts of your mortgage payment and get more house for your money.

TOP OF THE PAGE 800 910-4055. Its typical for a 15-year term to impact your mortgage rate. It also involves estate planning asset protection and much more than can be covered in this brief article.

Using your retirement savings to accelerate your mortgage payoff involves complicated analysis to determine what is best. This is the purchase price minus your down payment. PMI is generally required when your down payment is less than 20 percent of the home value.

It can also be used when deciding. If youll be using an adjustable-rate mortgage this amount only applies to the fixed period. There are several factors that determine your interest rate including your loan type loan amount down payment amount and credit history.

Thinking about buying a home. Assuming a 20. However putting down less than 20 means youll likely need to pay mortgage insurance and you pay more interest among other things.

Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Try it out Return to top of page. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan.

Although that rate. There are tax considerations on both sides of the savings equation. So this neat payment calculator will help you determine a realistic budget that suits your lifestyle and expected.

Redfins mortgage calculator estimates your monthly mortgage payment based on a number of factors. Now lets assume a first-time homebuyer gets buys that less-expensive home and makes a down payment of 20. Mortgage Repayment Calculator Australia Use this calculator to generate an amortization schedule for your current mortgage.

Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. 11 2022 was 546 according to BankRates analysis. A 225000 loan amount with a 30-yea r term at an interest rate of 3875 with a down-payment of 20 would result in an estimated principal and interest monthly payment of over the full term of the loan with an Annual Percentage Rate APR of 3946.

Choose a term and interest rate that best suits your needs and. The current average 30-year fixed rate mortgage as of Aug. Quickly see how much interest you will pay and your principal balances.

This is the best option if you plan on using the calculator many times over the. The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments. You can avoid a PMIand reduce your mortgage paymentby saving more for a down payment before signing on the dotted line.

Mortgage insurance which protects the lender in the event a borrower stops paying their loan adds to the overall cost of your monthly mortgage loan payment. You can even determine the impact of any principal prepayments. Which can be used to pay off the mortgage.

Knowing the actual numbers can help you determine if it makes sense. For many of the millions of American homeowners carrying a mortgage the monthly payment also includes private mortgage insurance homeowners insurance and property taxes. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of.

If you choose well also show you estimated. This is known as PITI. Interest rates are also determined by market trends.

The Payment Calculator can help sort out the fine details of such considerations. The estimated down payment is how much you plan on putting down. However some lenders have.

The monthly payment amount shown is based on information you provided and is only an estimate. Press the report button for a full amortization schedule either by year or by month. To make extra payments based on your financial goals.

However depending on your financial situation it might not be a good idea to take out a mortgage for the full preapproval amount. Talk to a licensed. For example if youre interested in paying off your mortgage off in 15 years as opposed to 30 you generally need a monthly payment that is 15X your typical mortgage payment.

Try it out. The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan. It does not include other costs of owning a home such as property taxes and insurance.

Now could be a good time to do it. Monthly mortgage payment Estimate monthly payments by adjusting loan amount interest rate terms and more. When it comes to calculating affordability your income debts and down payment are primary factors.

To determine the mortgages annual interest calculation lenders include valuation fees and redemption fees. You can also use the calculator on top to estimate extra payments you make once a year. The mortgage payment estimate youll get from this calculator includes principal and interest.

Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided. Use the calculator below to update your estimated monthly. While your personal savings goals or spending habits can impact your.

Mortgage Payment Protection Insurance MPPI MPPI provides longer mortgage protection for 12 months up to 2 years depending on your policy. As you explore potential interest rates you may find that you could be offered a slightly lower interest rate with a down payment just under 20 percent compared with one of 20 percent. Term and Interest rate.

Perfect if you are in search of a reliable fast and intuitive free mortgage calculator with taxes mortgage calculator with PMI. The mortgage amount rate type fixed or variable term amortization period and payment frequency. What Are Current Mortgage Rates.

30-Year Fixed Mortgage Principal Loan Amount. The USDA loan does not require a down payment but also doesnt restrict you from doing so. This is the best option if you are in a rush andor only plan on using the calculator today.

That larger down payment helps bring down monthly mortgage payments substantially.

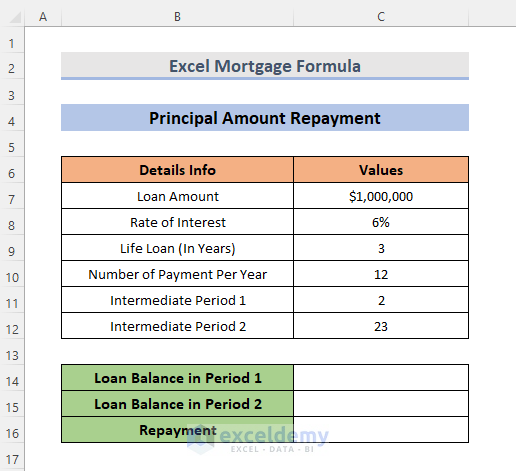

How To Use Formula For Mortgage Principal And Interest In Excel

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

Mortgage The Components Of A Mortgage Payment Wells Fargo

Va Mortgage Calculator Calculate Va Loan Payments

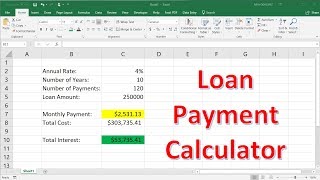

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

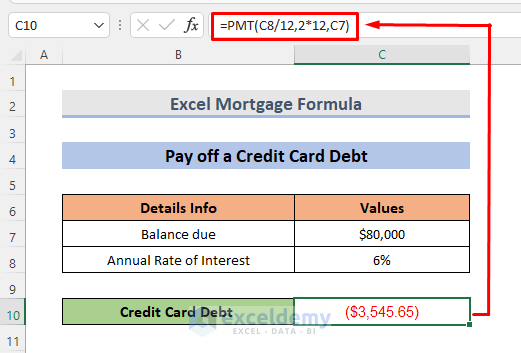

Mortgage Calculations With Excel Formula 5 Examples Exceldemy

How To Calculate A Mortgage Payment Amount Mortgage Payments Explained With Formula Youtube

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Mortgage Repayment Calculator

4 Ways To Calculate Mortgage Payments Wikihow Mortgage Payment Calculator Mortgage Payment Mortgage

Mortgage Calculator How To Calculate Your Monthly Payments Valuepenguin

How To Calculate Monthly Mortgage Payment In Excel

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube

Mortgage Calculator How Much Monthly Payments Will Cost

Calculation How Do I Calculate The Principal Paid Down On A Mortgage Personal Finance Money Stack Exchange

Excel Formula Estimate Mortgage Payment Exceljet

Mortgage Calculations With Excel Formula 5 Examples Exceldemy